Premium Finance — Leverage Your Assets

High-net-worth individuals typically need life insurance coverage in the millions or tens of millions of dollars to protect business assets and hedge inheritance and tax issues. A $25 million 30-year term-life policy for a 47-year-old non-smoking could run $4,700 a month. However, whole-life policy with cash value accumulation could run $15,000 a month.

If you do not wish to liquidate assets to pay for costly life insurance premiums upfront, consider the many advantages of premium finance.

The concept is simple enough: You take out a third-party loan to pay for the policy’s premiums. The lender charges interest; you repay the loan in regular installments until the balance is paid or you pass away, at which time the insurance proceeds pays the balance.

Of the many reasons to consider premium finance include:

Benefits to You

- Obtain large amounts of life insurance with a minimal upfront expense

- Retain your capital; pay only loan interest vs. actual premiums

- Avoid triggering capital gains tax

- Keep your money working earning in high-return assets classes

- Minimize gift and estate taxes by structuring policy ownership properly

- Use more of annual gifting exclusions; don’t tap prematurely into lifetime exemptions

- Increase long-term Internal Rate of Return by reducing outlay in early years

Control upfront costs, maintain Estate liquidity, increase cash flow.

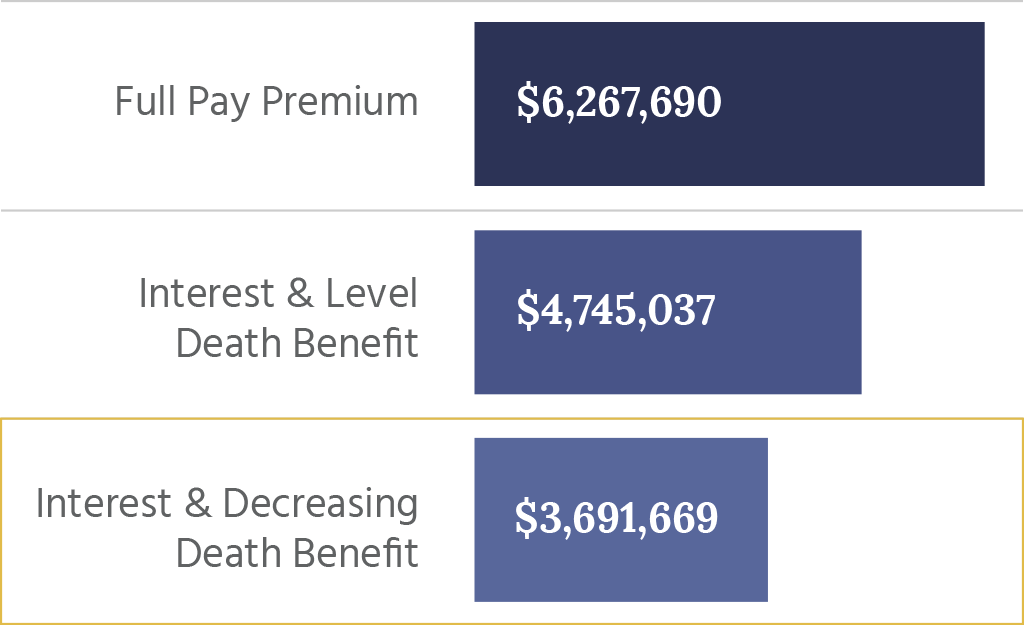

A typical client, age 70 (non-smoker), with a total Death Benefit of $10,000,000 (Level or Decreasing) and a Loan Interest Rate of Libor Treasury + 1.5% can see a savings of over $2.5 million.

- Full Pay Premium: Pay the full premium of $208,923 annually to age 100 for a total of $6,267,690 with a Death Benefit of $10,000,000.

- Interest & Level Death Benefit: Borrow the premium and pay interest starting at $10,204 increasing annually guaranteed to age 100 with a level Death Benefit of $10,000,000.

- Interest & Decreasing Death Benefit: Borrow the premium and pay interest starting at $7,939 increasing annually to age 100 with a decreasing Death Benefit starting at $9,791,077.

Making it Happen

Axia Global will set up an irrevocable life insurance trust (ILIT) to hold the life insurance policy and pay the loan interest. At your death, insurance proceeds pay the ILIT. When the trust pays off the loan, the remaining funds distribute to your heirs. Our process begins with a simple application and approval.

We work with a wide range of excellent third-party lenders to loan money to your ILIT, which then uses it to pay premiums to the insurance carrier. Also, the trust must pay interest on the loan. You, the insured, must gift the trust that interest payment money. Whatever funds you give the trust, gift taxes may apply.

You also must post collateral equal to the difference between the cash surrender policy value and the loan balance. Collateral requirements are set by the lender, though, so sometimes the actual value of the collateralized assets can be greater than the loan.

Mitigating Risk

As with all investments, certain risks may apply, like rising interest rates. Meet with us to discuss the opportunity costs involved in premium finance. We will review case studies, cover potential risks, and help you determine if this financial strategy fits your portfolio.

Millionaires don’t pay for insurance, they finance it.

Let’s discuss how premium finance can work for you.

Call us today for a courtesy consultation. 626.795.9590

Learn More

Domestic and International Estate and Tax Planning

Custom Solutions to Reduce Taxes