With Rachel pregnant and on bed-rest, Andy needed quick and healthy foods for his wife and yet-to-be-born daughter. It was the year 1987, and even in California, he simply couldn’t find anything organic and ready-to-serve on the market. With that, a new business idea was born.

Thank You, Small Business Owners

According to the Harvard Business Review, family-owned or -controlled businesses account for about 80% of companies worldwide. In the US, they employ 60% of the workforce. These include mom-and-pop shops, as well as large Fortune 500 companies. But even the largest family-run businesses had to start small, like Andy’s, with just a good idea.

While we are thanking small/family business owners for their role in supporting the economy (not to mention their gumption, stick-to-it-ive-ness, scrappiness, and savvy) we might as well think up some ways to make their lives a little better, and a little richer, too.

The Tax Cuts and Jobs Act of 2017 (TCJA) took some steps in the direction of helping small business owners. Several changes to the tax laws are temporary (these are noted below), and will not apply to tax years beginning after January 1, 2026, so business owners will need to move quickly to take advantage of any opportunities the new tax laws afford.

Tax Law Changes that Affect Businesses 101

While the tax rate changes for corporations are relatively clear-cut (and permanent), the new Section 199A regulations for “pass-through businesses” (this includes partnerships, sole proprietorships, S-corporations, trust and estates) are more complex.

- Corporate Tax Break: Corporations have gone from a tax bracket system with a 35% rate at the highest rung, to a one-size-fits-all, flat 21% corporate tax (permanent).

- Tax Break for Pass-Through Businesses: Taxpayers who own all or a portion of certain pass-through businesses may deduct 20% of their ‘qualified business income*’ (temporary). The highest possible deduction could effectively change their tax rate from 37% (at the highest tax bracket for individual) to 29.6%. This may not look like much compared to the new 21% tax for corporations, but it is not apples to apples. Recall that corporations are taxed twice; first the company, and then its shareholders (dividends) are taxed. Pass-through businesses are not.

- Reduced business interest expense deductions: Businesses used to be able to deduct 100% the interest it paid in any given year. Now, under the new law, deductions for business interest expense are limited to a max of 30% of the business’ taxable income in many cases.

The tax break is great news for many businesses, but it is important to note that some pass-through businesses either may not be eligible, or they may not be able to take the full deduction amount. Let’s unpack this a bit.

Limits on the New 20% Deduction

Pass-through businesses in certain service industries and those with very low costs will not qualify for the full tax benefit. Neither will individuals with a significant source of income from capital gains. In addition, business owners cannot deduct their own salary (no double dipping!) or their investment income.

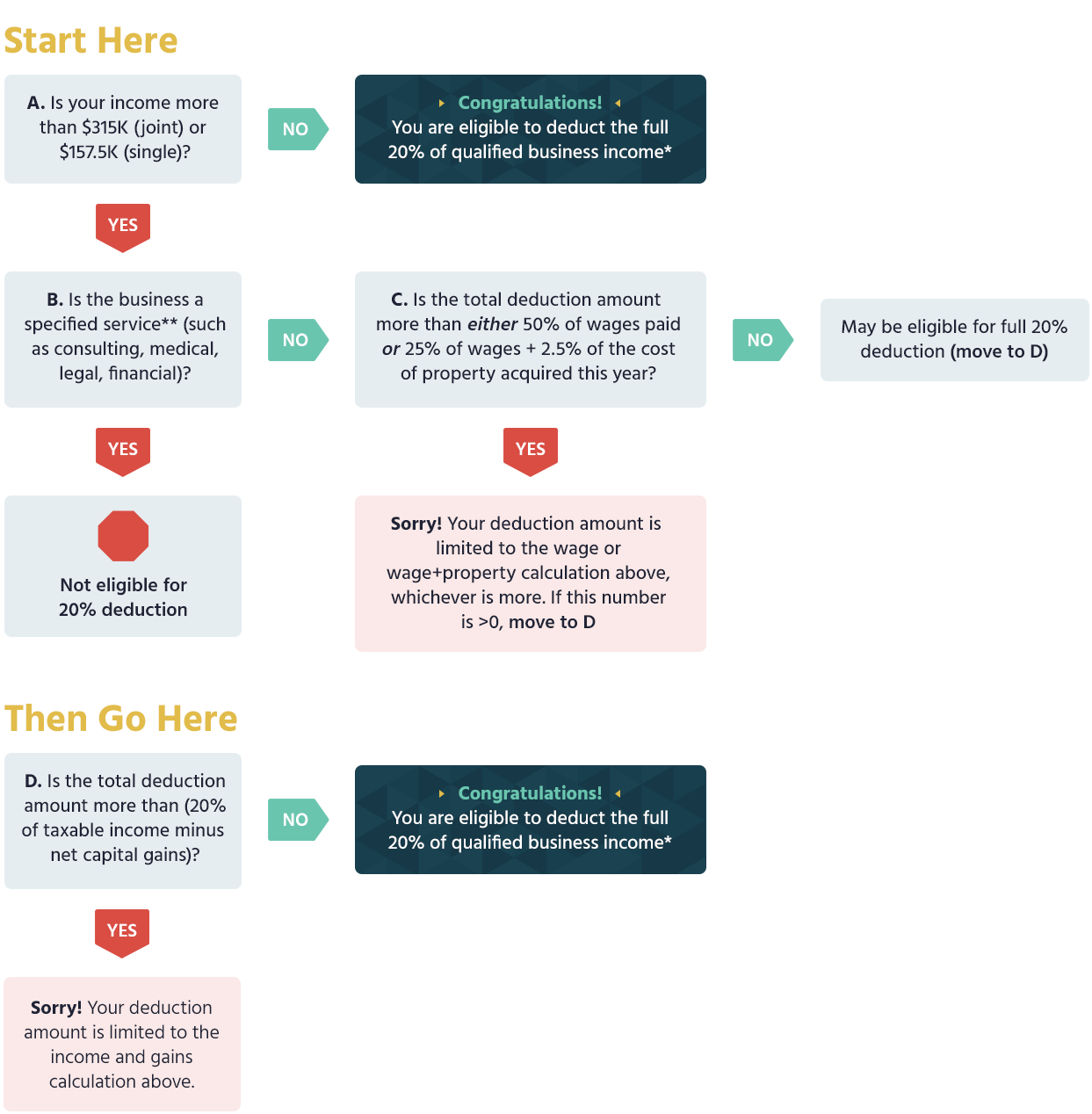

To determine an individual’s eligibility, it may help to think of the new Section 199A rules as a *fun* game:

Let’s say Andy runs a pass-through business that sells prepared foods, and earns $10 million in qualified business income in 2018. We’ll also assume that the business pays $5 million in wages (excluding himself), purchases a $4 million building, and has net capital gains from other investments of $0.3 million. If his family business is eligible for the full deduction, it would be a total of $2 million, resulting in winning a tax savings of $0.74 million.

Let’s play the game to find out his eligibility. Starting at A, we note that his income is greater than $315K, and he is not in a specified service business (B), so we move to C. So far so good [*stretches knuckles*].

Now, has he paid enough wages and/or acquired enough property in 2018 to be eligible for the deduction? First, we take 50% of the wages and get $2.5 million. Second, we take 25% of the wages plus 2.5% of the cost of property and get $1.35 million. Finally, we compare the two calculations and take the higher number of $2.5 million. Since this is greater than the $2 million maximum possible deduction, he may still be eligible for the full amount!

Let’s move to the last question (D). Take 20% of his taxable income ($2 million), minus $.3 million in net capital gains, and the total is $1.7 million. Since the full deduction of $2 million is greater than $1.7 million, the deduction amount is limited to $1.7 million. He will pay $3.07 million in taxes (37% of the remaining $8.3 million), and realize a tax savings of $0.63 million. Good game.

Four Steps to Maximize Tax Savings

With this in mind, Andy can take some steps to maximize his tax savings, and increase his chances of getting the full deduction in the next few years before it goes away. He shouldn’t forget to check back periodically to make sure the changes are still the best for the business, especially when tax rules revert at the end of 2025.

1 – Review the Business Structure

Let’s think long term for a moment. Unless Congress decides otherwise, the tax savings for pass-through business are temporary, while tax savings for corporations (regardless of size) are permanent. It may not hurt for Andy and his advisors to take a calculated look at whether Andy’s business would benefit from a switch to the status of a corporation. This change limits personal liability, but comes with certain obligations. Also calculations must be made to estimate whether the tax savings are still significant after shareholder taxes are taken into consideration.

Now let’s think big picture for a moment. If we take into account all the aspects of the business, there may be value in treating certain elements as separate entities. This may lead to better management of each component, and allow for them to be taxed separately (with the potential for even more deductions). For example, aspects of the business with greater liability risk could be separated to protect the remaining businesses. With Andy’s illustration above, ownership of a building (real estate investment) could be separated from the food preparation and packaging elements of the business.

2 – Review your Employee Policy

Since the Section 199A deduction is limited by the amount of wages paid out to employees, the more wages that are paid out, the greater the deduction. If he is already working with regular contractors, he may consider hiring them (and others) to become employees.

3 – Think about Your Purchases and Use of Debt

Andy may consider reducing how much debt he uses to fund his businesses since some of the interest expense may no longer provide a tax benefit. Also, interest expenses (and really any expenses) reduce his potential income, which means a lower possible deduction amount.

4 – Have an Exit Plan

Careful succession planning could result in significantly more wealth passed to the next generation, and it can also help ensure the longevity of the business. For example, Andy can set up a Family Limited Partnership and grant his daughter ownership of a portion of a business without granting her control of the business until she is ready. Since the estate and gift tax limit has been increased, large gifts of a share in a business or other assets will escape estate tax (up to $22.8 million) in the next few years.

On the other hand, if she doesn’t want to own the business, the exit plan may be to just sell the business. If that is the case, then timing of the sale while individual tax rates are at their lowest (before 2026) could result in some tax savings.

Andy’s current financial situation is purely hypothetical, but the story of how his business started is true. He became the solution to his own problem. In the the same year that his daughter was born, he launched a small business called Amy’s Kitchen. What was once 2 employees has grown to thousands of staff and a global presence; and they are still growing.

We hope you experience the same success, and that you can use some of these ideas to make the most of the tax reform. If you would like to discuss how to maximize potential tax savings for yourself, your affluent clients, family or friends, feel free to reach out to someone on our team. It is our goal to make a measurable difference in your financial life.

About Axia Global

Michael Roney, founder of Axia Global, has worked alongside the best financial and legal professionals in the field to craft profitable solutions for even the most complex wealth preservation and estate planning cases. Together, the team at Axia Global has nearly a century of combined experience in the financial services sector.

Note: the statements above should not be considered financial, legal or tax advice, but ideas for careful consideration with your trusted financial advisors and lawyers. For current tax or legal advice, please consult with an accountant or an attorney.

*Qualified Business Income is calculated as [Income from qualified business, net of gains losses or deduction +Real estate investment trust dividends + Publicly traded partnership income]

**Specified service trade or business (SSTB) includes a trade or business involving the performance of services in the fields of health, law, accounting, actuarial science, performing arts, consulting, athletics, financial services, investing and investment management, trading, dealing in certain assets or any trade or business where the principal asset is the reputation or skill of one or more of its employees.