The Rising Cost of Long Term Care Insurance

Recently, Long Term Care Insurance [LTCI] policy-holders are reporting that their premiums are becoming unpredictable. The most dramatic increases are affecting customers who have had these policies for the longest amount of time.

I don’t know that we can fully blame long term care insurance companies. They first offered this type of coverage at a time when there wasn’t much data on how much long term care would cost, and how many people would need some form of long term care. Now, they are claiming that they have grossly underestimated the size and volume of claims. Hence, increased premiums (just when long term care is most likely to be needed) for the people who bought the policies years ago when they were cheap.

The volatility of long term care insurance premiums gives us good cause to reconsider whether stand-alone long term care insurance is actually a viable solution. The question now is not whether coverage is needed, but what is the best way to obtain coverage.

The Rising Cost of Long Term Care

The LA Times notes that the cost of long term care for a private room in a nursing home can be close to $300 per day in California nowadays. That rings up to more than $100,000 per year. The American Association for Long Term Care Insurance notes that the average length of time spent in a nursing home is 3 years, which means the cost could total a whopping $300,000 in a lifetime. We won’t mention the fact that inflation will certainly have an impact on long term care prices in the coming decades.

With the promise of rising premiums, soaring medical costs, and a more than 50% chance of needing some form a long term care (check out my previous article for more stats), individuals in their 60s may be wondering how they can possibly afford to take care of themselves in their vulnerable years.

A Solution for Stable Coverage

As it turns out, some life insurance policies now offer an Accelerated Death Benefit (ADB); sometimes at no additional cost. The accelerated death benefit allows insured to access the policy’s death benefit should they become critically, chronically or terminally ill. Once they meet the criteria for receiving coverage, they often no longer have to pay the premiums. However, any payout they receive makes a corresponding reduction in the death benefit.

Here is How it would Work

- If you develop a Critical Illness…

Such as an organ transplant, heart attack, renal failure, blindness, cancer, stroke or ALS – you may get access to your entire death benefit to take care of yourself during this difficult time.

- If you develop a Terminal Illness…

That is expected to result in death within 24 months – you may get access to your entire death benefit to take care of yourself and your family.

- If you develop a Chronic Illness…

Such as an inability to perform 2 out of 6 activities of daily living – you may receive access to up to 2% of the death benefit each month to cover your costs. For example, if you need nursing home care, and the death benefit is $1 million, you would receive up to $20,000 per month to cover your long term care needs.

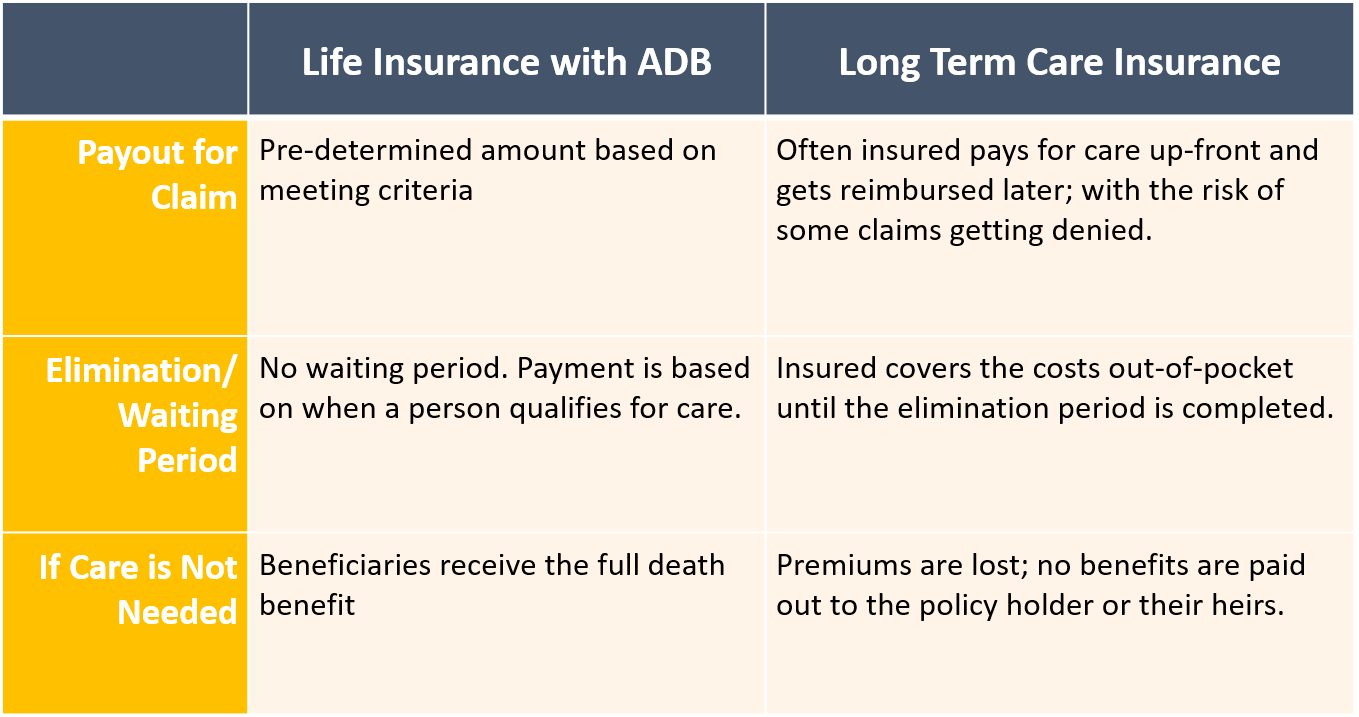

Side by Side

Life Insurance with ADB generally is more straightforward, more flexible, and more user-friendly than a stand-alone long term care insurance policy. This is why:

Next Steps

Let’s say you select a $500,000 death benefit for your life insurance policy with ADB. You calculate that this will cover a maximum monthly cost of $10,000 for your care (based on the max of 2% of the death benefit). Your premiums may range around $800 per month for the coverage, but only until you qualify for coverage. The monthly costs amount to less than 10% of the cost of your care. And if you don’t need the care, or use only part of the benefit, your heirs get the remaining payout.

- If you have already purchased long term care insurance:

There may not be much you can do to keep premiums from shifting. However, a knowledgeable advisor may be able to help you make the most of your current policy, and/or drop the policy and switch to a life insurance policy that works better for your needs.

- If you already have life insurance:

You may be able to add the accelerated death benefit option if is not part of the current policy terms.

- If you choose to purchase a new policy:

Be sure to work with an independent insurance agent who can shop around to find the best policy for the best price to suit your long term care needs. Ask your broker to demonstrate how the policies differ in terms of qualifying for long term care, pricing and coverage so that you can make an informed decision.

If you would like help determining the best fit for your long term care needs, feel free to give us a call. It’s our goal to make a measurable difference in your financial life.

Note: The statements above should not be considered financial, legal or tax advice, but ideas for careful consideration with trusted advisers.

About Axia Global

J. Michael Roney, founder of Axia Global, has worked alongside the best financial and legal professionals in the field for decades. He has written a book on wealth preservation, and his calling is to craft profitable solutions for even the most complex wealth preservation and estate planning cases. Together, the team at Axia Global has nearly a century of combined experience in the financial services sector.