Slow and steady wins the race, so they say. But what happens if just before the finish line, the hare picks up the tortoise, places him back at the halfway point, and races to an unheralded victory?

Think of your retirement savings as the tortoise, and taxes as the hare. After you have accumulated your wealth, taxes will inevitably reduce your savings. Here is a secret to protecting your nest egg while enabling it to grow: keep your money in 2 different pockets – taxable and untaxable.

Taxable Pocket

Taxable accounts include mutual funds and other standard forms of investment. Many retirement plans end here. The effect from the 2017 Tax Cuts and Jobs Act is that many people will pay lower taxes for the next 7 years. However, in 2026 many of the tax provisions that were beneficial to individuals will revert back to 2017 levels. Here are some of those temporary provisions:

- Overall rates will go back up to 39.6% at the top bracket (from 37% now).

- Pass-through businesses will lose the 20% tax deduction (Section 199A) they currently enjoy.

- The amount of income exempt from the AMT Alternative Minimum Tax has increased temporarily, with the effect of reducing taxes for many people in the short term.

If taxes have been reduced overall for an individual, now (before 2026) might be a time to tap into the taxable pocket and pay lower income taxes on your withdrawals.

Untaxable Pocket

This type of asset includes all insurance policies. Under Section 7702 in the IRS code, insurance loans are not taxed, withdrawals (up to what you put in) are not taxed, and the death benefit is not taxed. Interest for policy loans is covered by the money earned on your cash value, and can be paid back by the death benefit if need be.

Most people think of life insurance as a way to preserve wealth for the next generation, but life insurance can also be used as an untaxable retirement savings vehicle.

Indexed insurance policies protect your assets but also allow you to peg your money to an index or group of indices (for example, S&P500, Hang Seng, Stox-50, etc) to encourage cash value growth. At the same time (and possibly most importantly), you are setting a hedge of protection around your assets so that the IRS will never have access to it.

Mutual Fund(Taxable) Vs. Indexed Life Insurance Policy (Untaxable):

Let’s say you’ve owned a small business, and until now, your assets have been tied up in the business. You want to fast-track your retirements savings, and wonder whether to add to the taxable pocket, or build up your untaxable assets.

Let’s compare the two pockets (taxable and untaxable) to determine where to invest. For our comparison, assume that:

- At age 60, you invest $200,000 per year for 5 years, and expect to let the interest accumulate for a few years before you begin receiving an annual payout.

- You would like your annual payout to be around $150,000 per year for at least 15 years (until age 86).

- Both investment options earn 7.10% annually

- Mutual fund calculations assume the gain is taxed at 15%, sales charges are 4%, and management fees are 1.5%

- Insurance policy death benefit and calculations are net of insurance costs

The Results

The insurance policy outperforms the mutual fund in the long term because it is never taxed. This allows for more cash flow to the investor, as well as some death benefit for wealth transfer. Note that the death benefit begins immediately with a large sum.

- Total Expected Distributions from the Indexed Insurance Policy: $2,239,065

- Total Expected Distributions from the Mutual Fund: $1,763,502

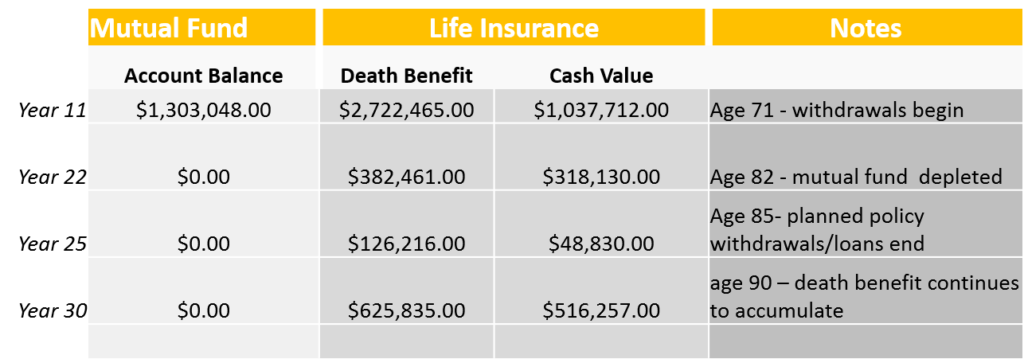

Here is a snapshot of how the accounts performed at different points in time after the initial $1 million dollar investment. Withdrawals begin at year 11:

Based on our assumptions, the mutual fund is depleted in year 22, only 11 years after the withdrawals began. The insurance policy continues to provide an annual outlay until year 25. After year 25, the insured will allow his policy to build without further withdrawals. The death benefit at age 90 would be over $600,000. Slow and steady finally wins the race.

If you would like to determine if the the Estate Asset and Retirement Program would work for you, you can call us for a confidential conversation. We can identify solutions tailored just for you or your affluent clients. It’s our goal to make a measurable difference in your financial life.

Note: The statements above should not be considered financial, legal or tax advice, but ideas for careful consideration with trusted advisers.

About Axia Global

J. Michael Roney, founder of Axia Global, has worked alongside the best financial and legal professionals in the field for decades. He has written a book on wealth preservation, and his calling is to craft profitable solutions for even the most complex wealth preservation and estate planning cases. Together, the team at Axia Global has nearly a century of combined experience in the financial services sector.