It’s never too late to start making better choices. Each New Year offers an opportunity for a bit of healthy introspection, a chance to do something differently. Here is why creating a Family Legacy Trust should be at the top of the New Year’s Resolution list this year:

- New tax reform laws effective as of January 1, 2018 allow your total lifetime gift tax exclusion to increase from $5.49 million per person (nearly $11 million per married couple) to $11.2 million per individual/$22.4 million per married couple (according to the IRS, this number may change slightly as they make adjustments for inflation). Your successors will not pay any estate tax as long as you bequeath them less than $22.4 million. Since the estate tax rate is 40%, this could represent a significant savings. Last year, that same $22.4 million estate would have owed $4.6 million in taxes. As a result, the new law creates an opportunity to gift large sums of money tax-free.

- Since the new tax exemption limit is set to revert in 2026, you have only an 8-year window (or less) within which to take advantage of the higher exemption rate (and be grandfathered under this law). Your time may be even shorter; it is a very real possibility that the Democrats will regain power and dismantle the tax reform bill before 2026.

- A well-planned Family Legacy Trust will be exempt from estate taxes; so that you can give now, while it is tax free, and ensure that future generations won’t ever have to worry about estate taxes.

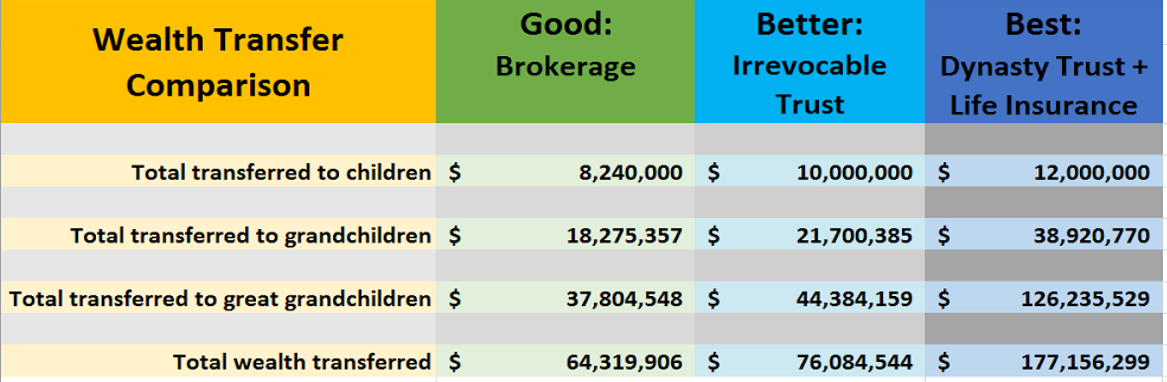

- If you compare a death benefit of $12 million through an insurance policy within a Family Legacy Trust to a $10 million estate through a brokerage account, the difference could be nearly $113 million by the 3rd generation (see below).

Now that was a mouthful. So let’s pause, catch our breath, and define a Family Legacy Trust. Sometimes called a Dynasty Trust, this irrevocable trust enables you to transfer assets from your estate to your trust. In some states, a Family Legacy Trust must expire in 90 years, or 21 years after the death of the last beneficiary who was living at the time the trust was created. In other states (you probably want to create your trust in one of these states), the trust can be perpetual. In that case, even your great great grandchildren can enjoy the benefits of your wealth.

A key benefit of a Family Legacy Trust is that all transfers to your trust are removed from your taxable estate, avoiding estate taxes. For the same reason, the assets are protected from creditors, since you and your beneficiaries do not technically own assets held within the trust. The drawback is that you no longer retain the rights to the assets.

However, you do set all the terms for the trust. For example, you name a trustee (or a few) who will best determine how to invest the funds, and who will distribute funds to your beneficiaries. You also can stipulate how the funds are disbursed, to whom, and on what conditions.

Amassing Wealth

Now let’s talk about how a Family Legacy Trust can enable assets to grow more than other estate preservation techniques:

- When you set up a Family Legacy Trust with knowledgeable advisors, no estate tax is ever owed on the assets within the trust, allowing greater amounts of wealth to compound and transfer to the next generations.

- If you have the trust purchase a life insurance policy on your life, the death benefit will be distributed to the trust, and any growth in the cash value will not be taxed, since it was held within the policy. Consider having the trust specifically purchase Private Placement Life Insurance, detailed in our previous blog. No income tax + no estate tax = greater wealth transfer.

Wealth Transfer Comparison

Let’s take a look at just how much of a difference the Family Legacy Trust can make. Assume your estate is $10 million, each generation outlives the previous by 30 years, and the funds grow at a rate of 4% each year (net of income taxes). The estate tax exemption is $5.6 million (the 2017 rate with an adjustment for inflation), and the estate tax rate is 40%. The chart below shows how much of your wealth is transferred to subsequent generations:

Good (Traditional Brokerage Account):

Your estate is $10 million. Your children have to pay estate tax, so they receive only $8.24 million. They are happy.

The account grows, but estate taxes are due at the death of each generation. By the 3rd generation, $64 million has been bequeathed to your family members, and $31.5 million has been bequeathed to Uncle Sam.

Better (Irrevocable Trust):

Let’s assume you instead choose an irrevocable trust. The trust pays income tax each year, and assets are distributed when the trust expires upon your death. Estate tax is avoided for the first generation, so your children receive all $10 million. They are happier.

The account grows, but estate taxes are due for each subsequent generation. By the 3rd generation, $76 million has been bequeathed to family, and $36.6 million has been bequeathed to Uncle Sam.

Best (Family Legacy Trust, with a Life Insurance Policy):

You set up a family legacy trust. The trust purchases a life insurance policy, and the death benefit is $12 million, free of estate or income taxes. Your children receive all $12 million. They are happiest.

The account grows, and NO estate taxes are due at any time. By the 3rd generation, a whopping $177 million has been bequeathed to your children and their children.

The Best Time to Act

The new tax laws have created a unique opportunity for you to leave a lasting family legacy. If you would like to discuss setting up a Family Legacy Trust with an Axia Global professional (for yourself or your affluent clients), please give us a call. It is our goal to make a measurable difference in your financial life.

Note: the statements above should not be considered financial, legal or tax advice, but ideas for careful consideration with your trusted financial advisors and lawyers. For current tax or legal advice, please consult with an accountant or an attorney.